Top News

After the implementation of the rate hike of the Goods and Services Tax (GST), many essential food items and commodities are set to get costlier for consumers, including rice, wheat, flour, and several packaged food items. Customers will have to shell out more money for cereals, cutlery, and many other “pre-packaged” items sold in India. The GST rate hike has been implemented for food items that are branded and packed in a unit container, as per official reports. Pre-packaged and labeled pulses and cereals like rice, wheat, and flour (atta) will now attract GST at the rate of 5 percent when branded and packed in a unit container. Puffed rice, lassi, and curd that come packaged also come into this category. Items like printing, writing, or drawing ink, knives with cutting blades, paper knives, pencil sharpeners and blades, spoons, forks, ladles, skimmers, and cake-servers will attract 18 percent GST, instead of 12 percent. GST on Tetra Pak (or aseptic packaging paper) used for packaging liquid beverages or dairy products has been hiked by 5 percent, and now stands at 18 percent. Jewelry is also set to get more expensive as cut and polished diamonds will be taxed at 1.5 percent compared to 0.25 percent earlier. Travel expenses are set to soar with the prices of hotel accommodations hiked. The hotel accommodation rates up to Rs 1000 per day will now be now taxed at 12 percent. The GST on power-driven pumps such as centrifugal pumps, deep tube-well turbine pumps, submersible pumps, and bicycle pumps has also been increased to 18 percent. Pre-packaged and labeled pulses and cereals like rice, wheat, and flour (atta) that are branded and packaged in unit containers will attract 5 percent GST. Other items such as curd, lassi, and puffed rice too would attract GST at the rate of 5 percent when pre-packaged and labeled, as per ANI reports. Items such as LED Lamps, lights, and fixtures, their metal printed circuits board will now be taxed at 18 percent, not the previously-set 12 percent rate. GST rate revised: Here are some commodities set to get cheaper As per the revised GST rates, the tax on transport of goods and passengers by ropeways would decline to 5 percent from 18 percent. Renting of truck/goods carriage where the cost of fuel is included will be cheaper as the tax is reduced to 12 percent instead of 18 percent. GST on orthopedic appliances has been reduced to 5 percent from 12 percent.

More

CISCE ISC Class 12 Result 2022: Marking scheme, how to download here

CUSAT Result 2022 released at admissions.cusat.ac.in: Check important details here

Karnataka CET Result 2022 to be out soon: Website, how to check here

CISCE ISC Class 12 Result 2022: Marking scheme, how to download here

Brahmastra: Ayan Mukerji defends use of 'love storiya' in Kesariya song, says 'didn't find it like elaichi in biryani'

Centre planning to cut prices of critical medicines for diabetes, cardiovascular and kidney diseases: Report

CISCE ISC Class 12 Result 2022: Marking scheme, how to download here

More

The Family Man actress Shreya ...

Sara Ali Khan looks sizzling h...

6 times Janhvi Kapoor handled ...

Sanju Samson to Rahul Tripathi...

Sara Ali Khan looks sizzling h...

Rare photo of Gyanvapi complex...

More

Meet Arvind Goyal, Moradabad man who donated his wealth worth Rs 600 crore to UP government top-stories Fire breaks out in

Fire breaks out in Kandi forest area in West Bengal's Murshidabad district

Man on Delhi-bound IndiGo plane claims bomb in bag, flight grounded

CBSE Class 10 Result 2022: From how to check to past year result trends

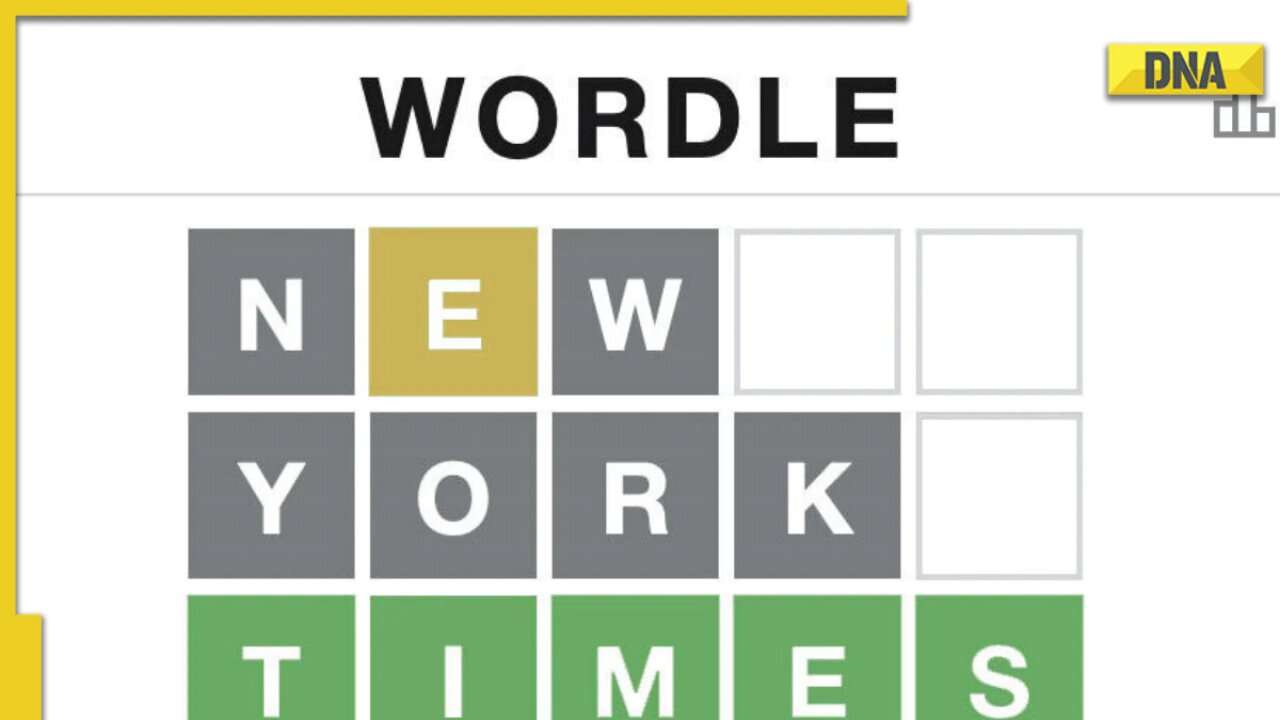

Wordle 398 answer: Here is the Wordle answer for July 22

More

DNA Exclusive: Brad Hogg talks about racism in cricket, says 'anyone who's racist is not that intelligent'

DNA Exclusive: Another Maharashtra in offing? Soren-Shah meeting catches eyeballs in Jharkhand

Bandon Mein Tha Dum: The IND vs AUS Test series was fought with blood, brains and brawn, says producer Sudip Tewari

'We keep on fighting,' says Jasprit Bumrah on MI's chances of winning IPL 2022 | Exclusive

DNA Exclusive: Harbhajan Singh claims MS Dhoni, BCCI forced him out of Team India